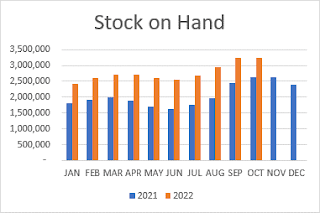

"What was a supply chain crisis during the pandemic is now an inventory crisis with money tied up in products just sitting on a shelf. New data shows [New Zealand] companies are holding twice the level of stock compared to pre-pandemic levels [...].” This was the introduction to a well-researched news item in TV1 News on 3 December 2022. Watch it on YouTube.

10 December 2022

29 November 2022

Inflation Predicted

These comments were

made way back on 9 April 2020, during the first lockdown. A video of the interview

is in YouTube. At around 3 minutes:

“If you think that you can rely on your savings for your old age – think again. We’ve been there before. In the early seventies, we had the oil crisis. Most countries went into spending huge amounts of money. That is precisely what we are doing now. So, this fifty-billion-here, fifty-billion-there must be paid somehow. The usual way is with rampant inflation and no growth.”

15 November 2022

Performance Update

25 October 2022

Progress Report

11 October 2022

Just In Time: The End?

29 August 2022

The Most Open and Transparent 3PL

We are claiming this

title. Have a look at the new “3PL Costs” page in our website. It will look like

this:

14 July 2022

Supply Chain Disruptions: They Disrupt

We are in the middle of a surge in the arrival of new

stock. We are also in the middle of a second Covid wave. Not every container

can be unpacked immediately on arrival. That is annoying but maybe not quite as

bad as being held in a leaking tent, awaiting a turn to enter the emergency

department of a hospital in our largest city.

Our staff do their best to give priority to genuine urgencies. When everything is urgent, nothing is. Containers that unload from ships in Tauranga take about three weeks to reach Auckland, a three-hour drive away.

We continue to be subject to Covid-related absenteeism and have difficulty finding new staff. There is a waiting list of several months for us to get delivery of goods-handling equipment. Most warehouses, ours included, are full to the rafters and few are being built. Yet, this too will pass. The large inventories accumulated by some importers will have to move out, sooner or later.

We have adopted several measures to mitigate the current difficulties. We leased a fourth warehouse that acts as a processing centre for the other three. That will enable us to convert the processing areas in those warehouses to high racking, substantially increasing our storage capacity. We bought two additional trucks to cover the movements to the processing centre. Our immediate expenditure on those measures was about $900k, including an additional recurring annual rent of $300k.

We will continue to provide updates on local conditions, so

that they are visible to you. We ask you to work cooperatively with our

warehouse managers to increase communication for both parties, so we can do the

best we can during this period of disruption.

25 June 2022

Travel Notes

15 May 2022

Friendshoring

The past two years have presented importers with large

increases in freight costs and the loss of reliability of freight schedules.

The freight costs will eventually come back to pre-pandemic levels. That is because the extraordinary profits of the major shipping lines have attracted new players keen to get a share of that bonanza. Capacity will increase and so will competition.

Likewise, freight schedules will return to some level of predictability, as supply chains gradually adapt to the new conditions. The capacity to spontaneously adapt is what makes supply chains so resilient. They are a product of millions of decisions made independently by millions of individuals, every day.

So, Covid-related disruptions will come to an end but there are two other factors at play which are of present concern to importers. The first is the need for democratic nations to realign their trade to other democracies. The second is the looming inflation and the resulting corrective recessions, which could adversely affect economies for years to come.

Two examples of the perils of trading with dictatorships: (1) Germany becoming dependent on Russian gas while dismantling its nuclear energy sector; and (2) many other countries’ decisions to subcontract manufacturing to China.

China’s zero-Covid folly is one that we are familiar with, having tried it here. Our attempt to eliminate Omicron was only abandoned when people decided that it was futile and stopped complying with the increasingly absurd isolation mandates. In China, however, the option to change course when mugged by reality is not in play, as rulers there appear to believe themselves to be infallible.

Importers in the rest of the world will be affected by the resulting disruptions. As they realise that the lure of cheaper labour is not sufficient to outweigh the uncertainties inherent in dictatorships, like a brutal lockdown here or a small neighbourly invasion there, they may start to trade more with other democracies. This tendency even has its own buzzword: “friendshoring”.

The other cloud on the horizon is the looming inflation and the inevitable corrective recessions. This is the result of some believing that “this time it’s different”. It wasn’t. This too will pass, but it may take a decade or two.

In May of 2021 we were storing 3.1 million units of stock.

Today, we are storing just over 4 million, an increase of 29%. This is an

illustration of how supply chains are fast to adjust to changing conditions. Most of

our clients decided (wisely in our view) to increase their inventories. We are responding

by increasing our storage capacity.

On 1 June, we will take possession of a fourth warehouse in Mangere.

This warehouse, unlike the others, will not be used for a specific set of clients. Instead, it will become a fulfilment centre for the other three warehouses. That will enable us to centrally deploy our automation investments and increase the storage space available in the main warehouses.

23 February 2022

Labour Capacity Reduced, Targets Increased

We have started to experience labour shortages caused by isolation mandates. We expect these shortages to increase and to continue until the attempt to resist the spread of Omicron is abandoned.

The result will be an increasing difficulty in us meeting processing targets. We are currently running about one day behind. We will keep you informed on how we are tracking and will review the job completion targets weekly. This notice will appear in our Portal page:

The target date extension applies only to new jobs. These notices will be updated every Wednesday afternoon (pay day) with data from the previous week.

20 January 2022

We Are Running Short of Cartons

The supply chain challenges continue to grow. Now, we are

facing a shortage of cardboard cartons.

I have just received notice from our main supplier that we are nearly out of our custom-specified cartons. Our supply agreement with them includes a commitment for 3 months’ supply at any given point. However, the cardboard manufacturer is so far behind that there are no reserves.

It seems that all alternative manufacturing avenues are in a similar situation. At this stage, we will not get any new stock until around February 8.

The reason we specify custom carton sizes is that they fit your order profiles and courier breakpoints. That ensures that you get the best value in carton utilisation and freight cost.

I have instructed all our teams to immediately re-use, re-use, re-use the cartons the goods arrive in. We have also secured a supply of some generic sizes, to keep disruption to a minimum.

The downside of this is that there may be instances where our packaging choices will not be the best for you. Please bear with us on this; we hope it is only temporary. Our teams will continue to try to pack your orders in the most efficient manner possible.

Please contact your warehouse manager or me at any time to discuss this issue.

Preparing for Omicron

When Omicron enters the community, we may see large numbers of people labelled as close contacts being forced to stay home and isolate. This means we could see big workloads while being short-staffed and unable to work at full capacity.

We are hoping we don’t end up in this situation but, in case we do, we are setting up our customer service teams now with the training and equipment for remote work.

Our warehouse managers will be in touch with you, if and when the need arises, to discuss a plan to achieve the least possible disruption to your business and customers. This would be a big-picture plan rather than selecting specific orders for priority, as that could have the potential to further slow processing.

We suggest that you too start to prepare in case this

situation arises and discuss with your customers the impact of possible future

warehousing and courier delays.